The Problem

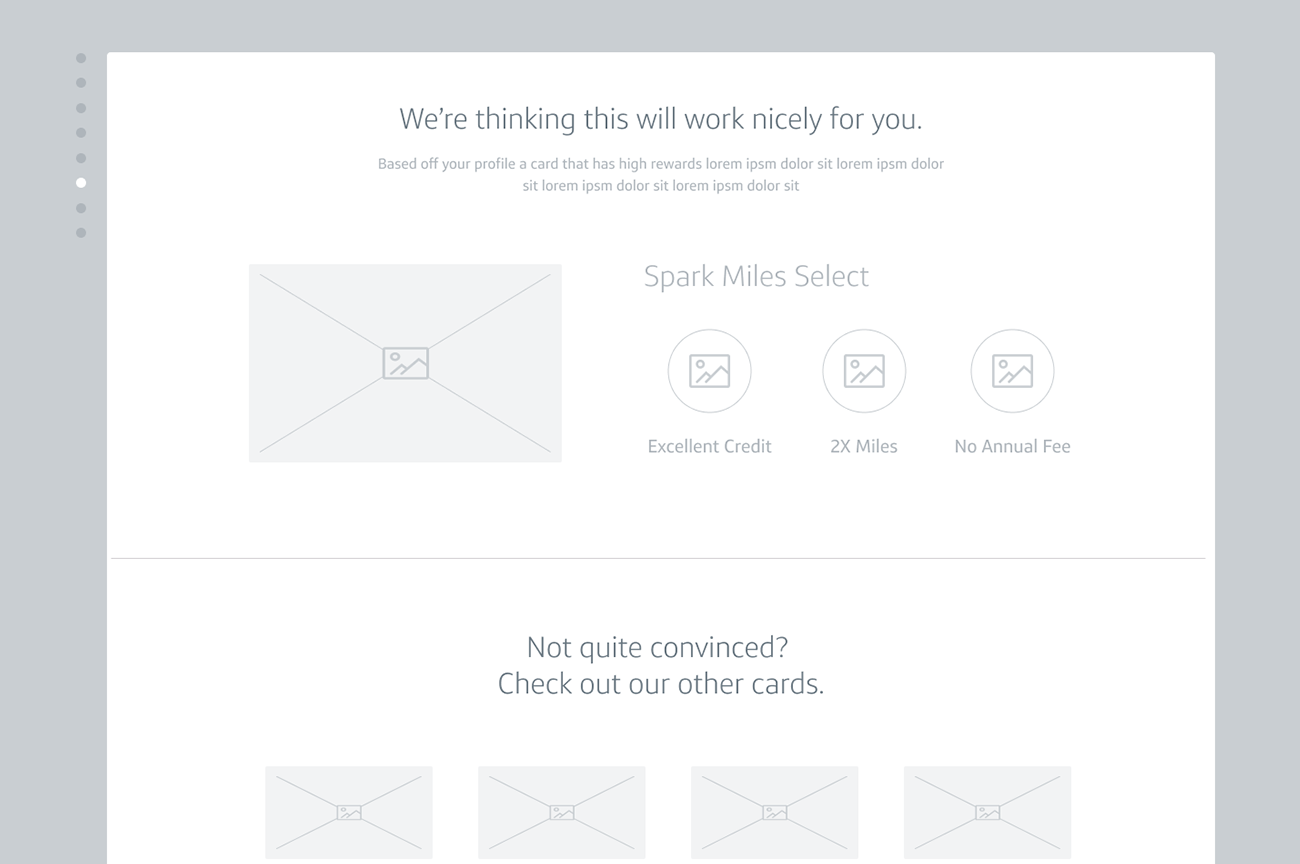

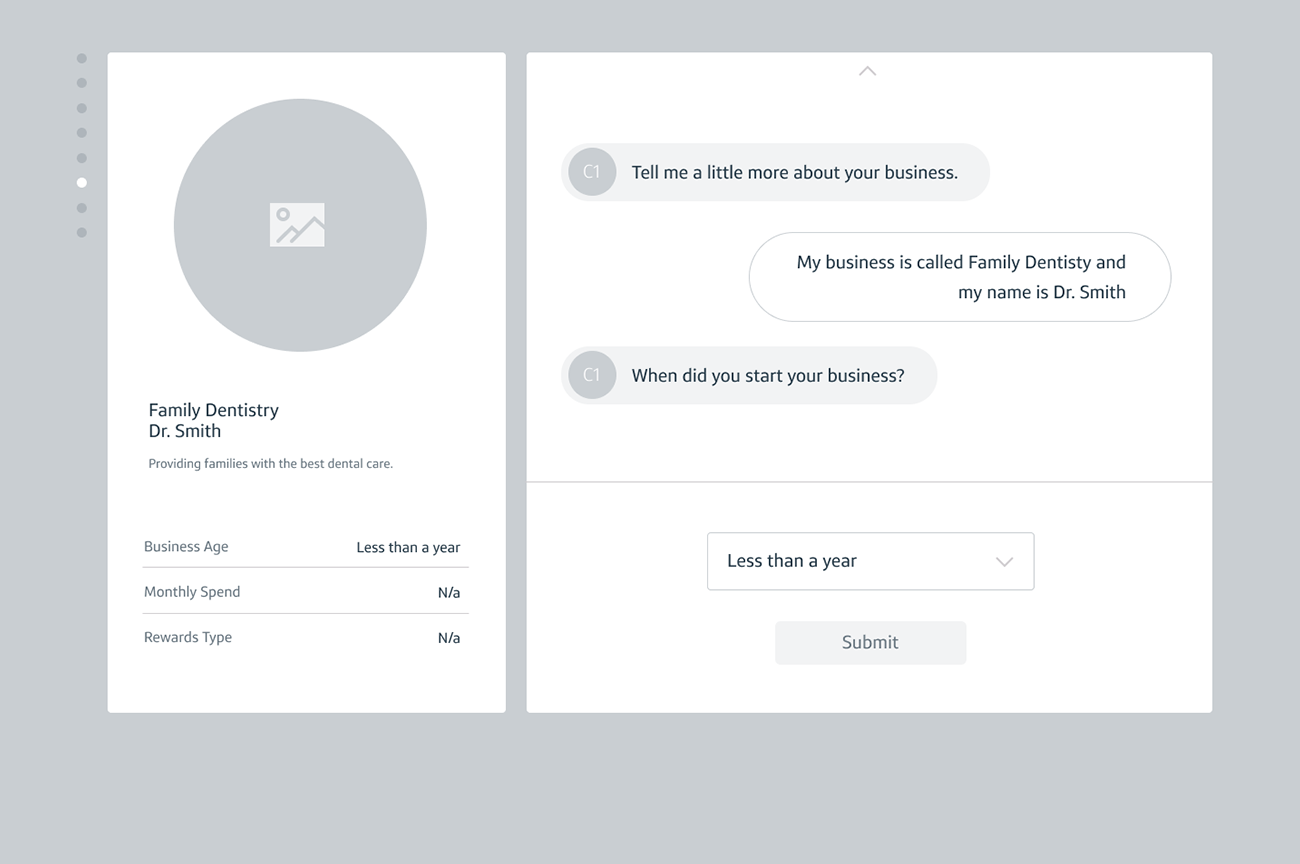

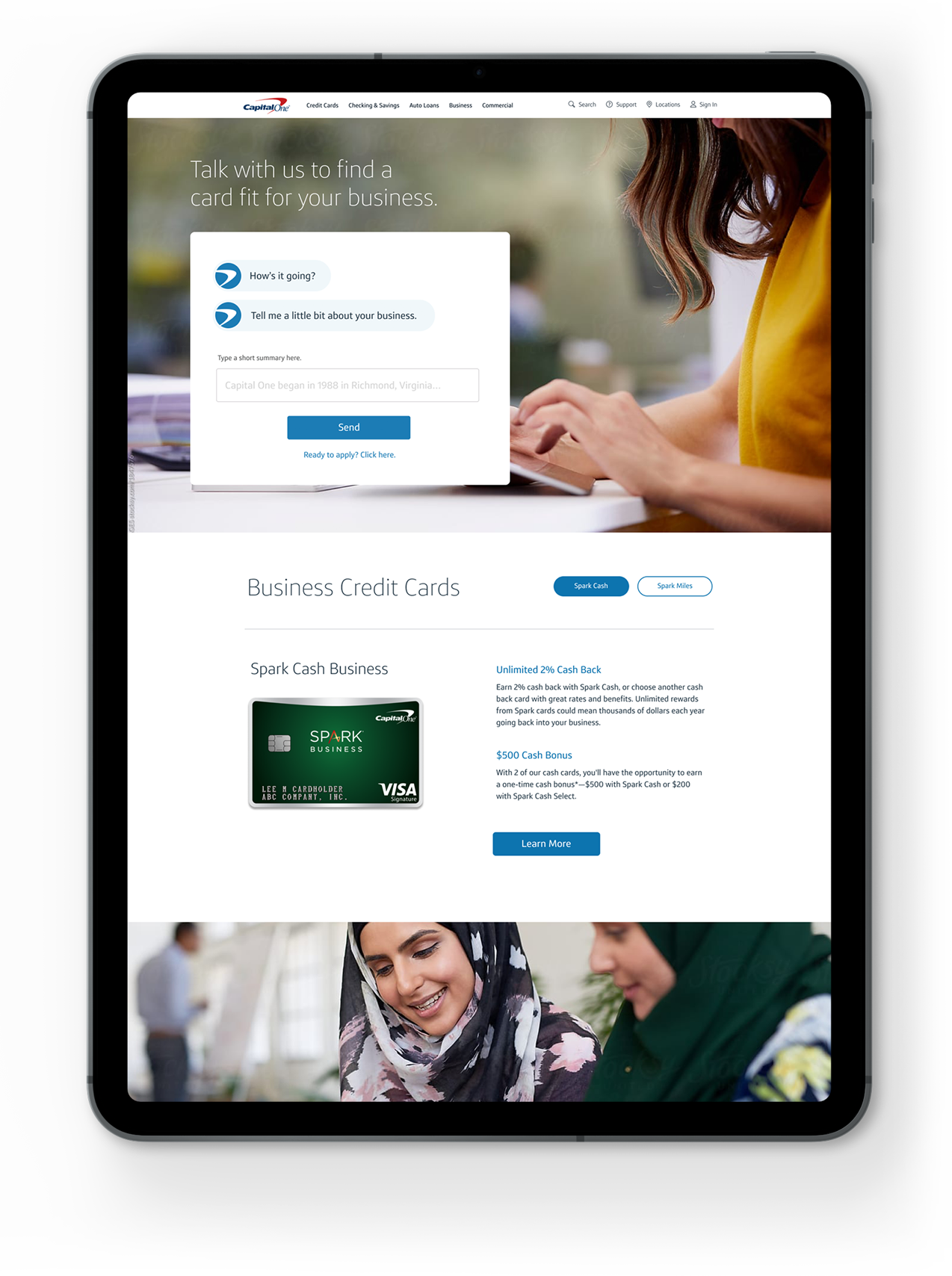

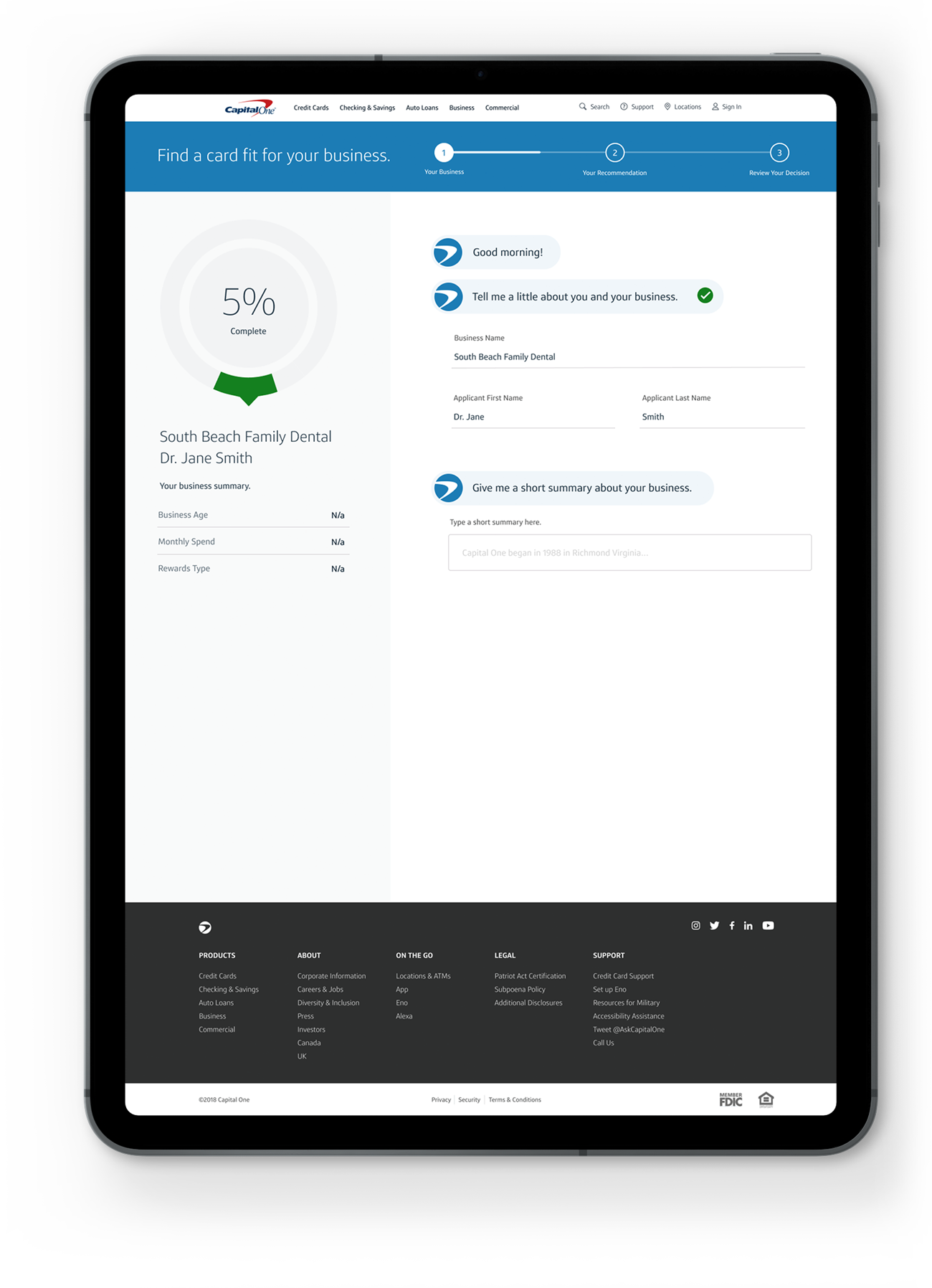

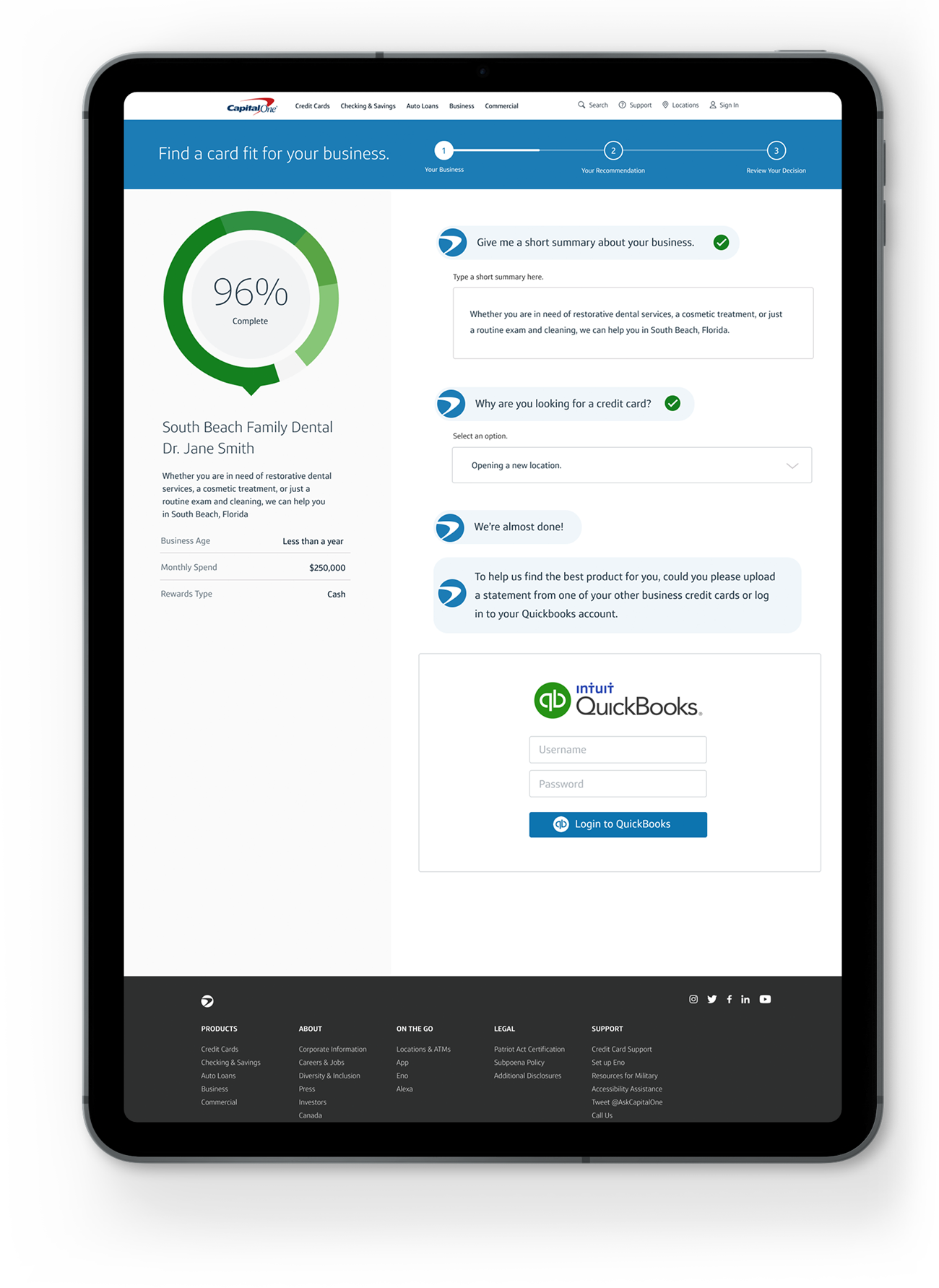

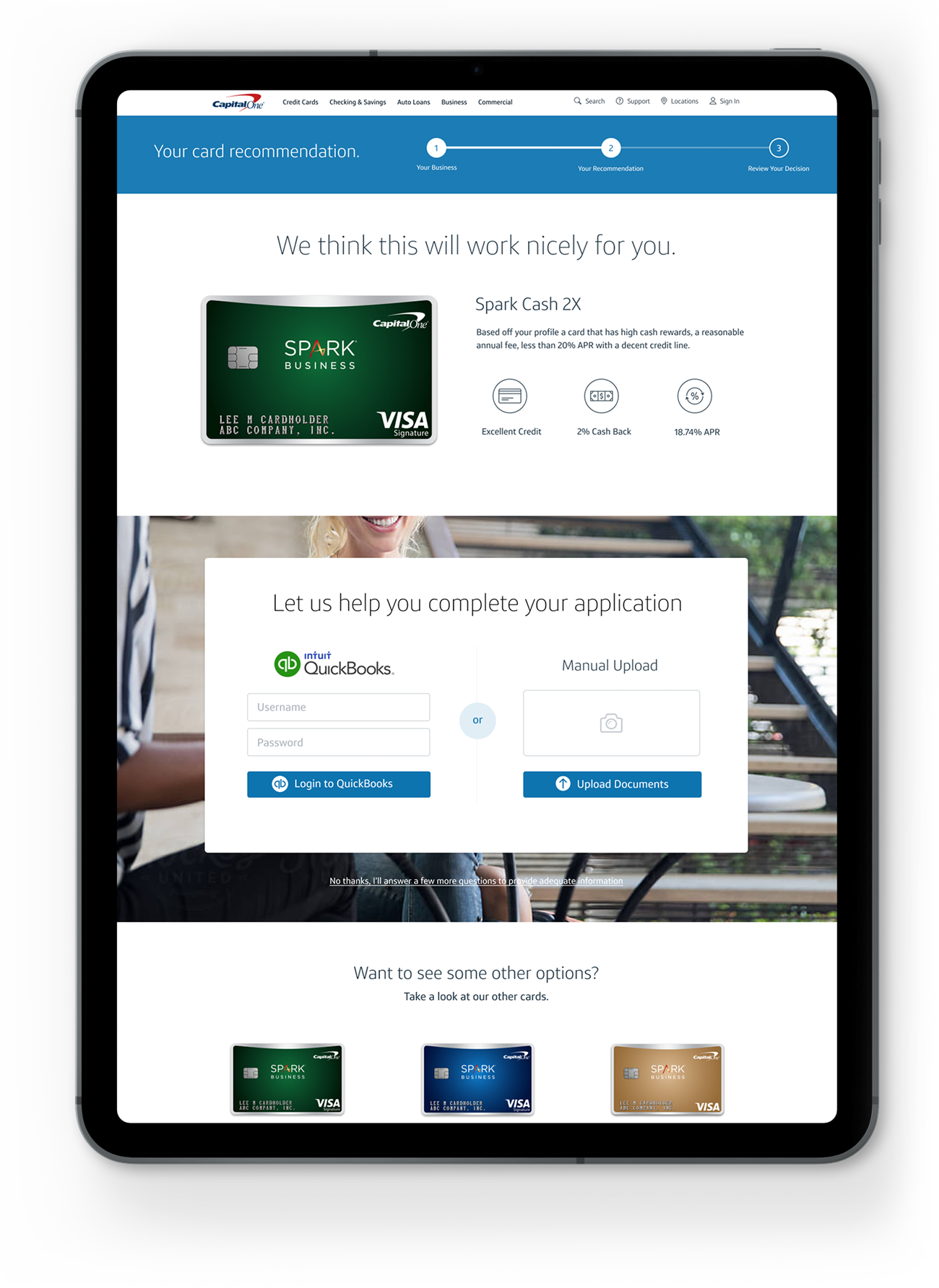

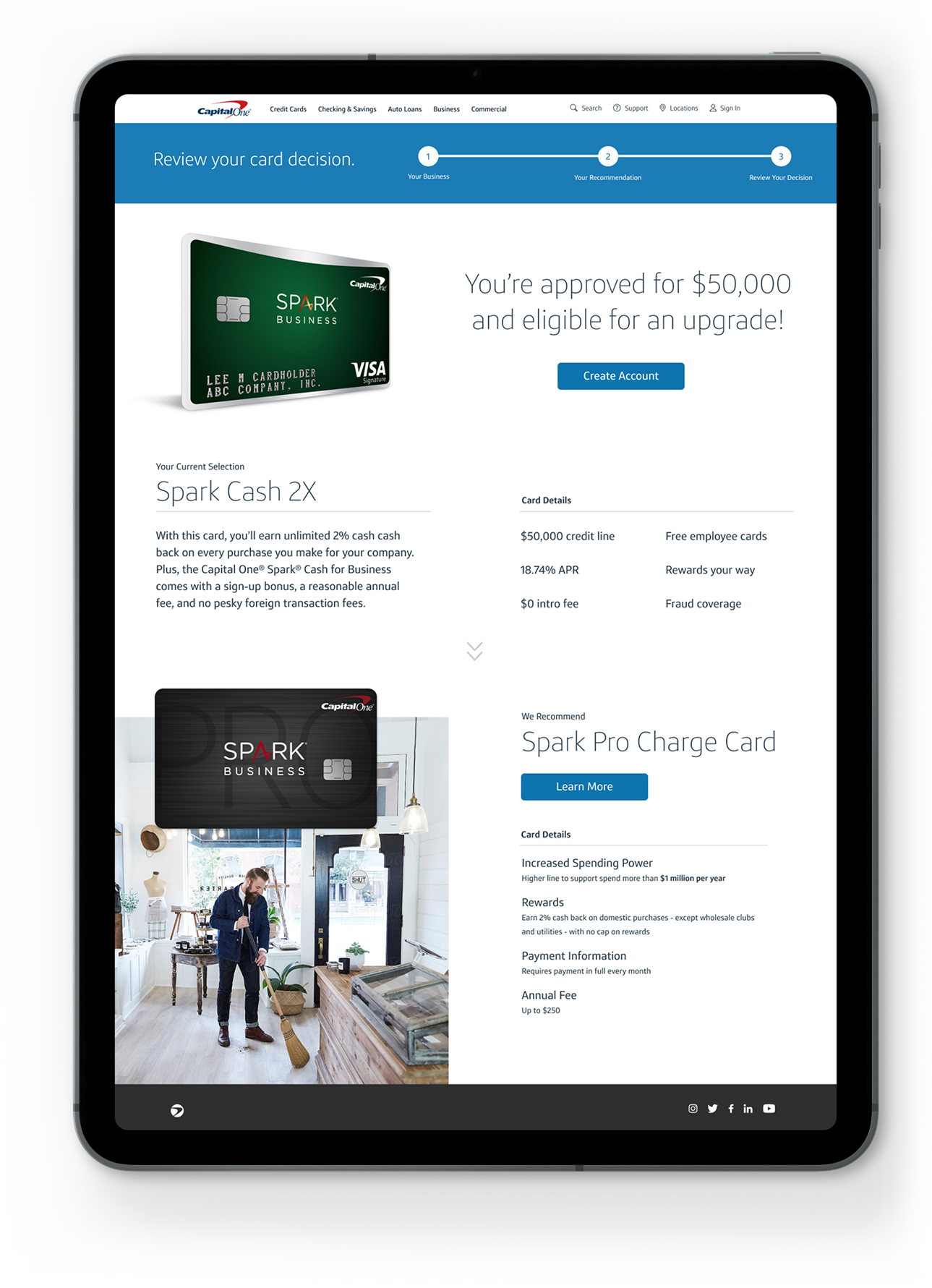

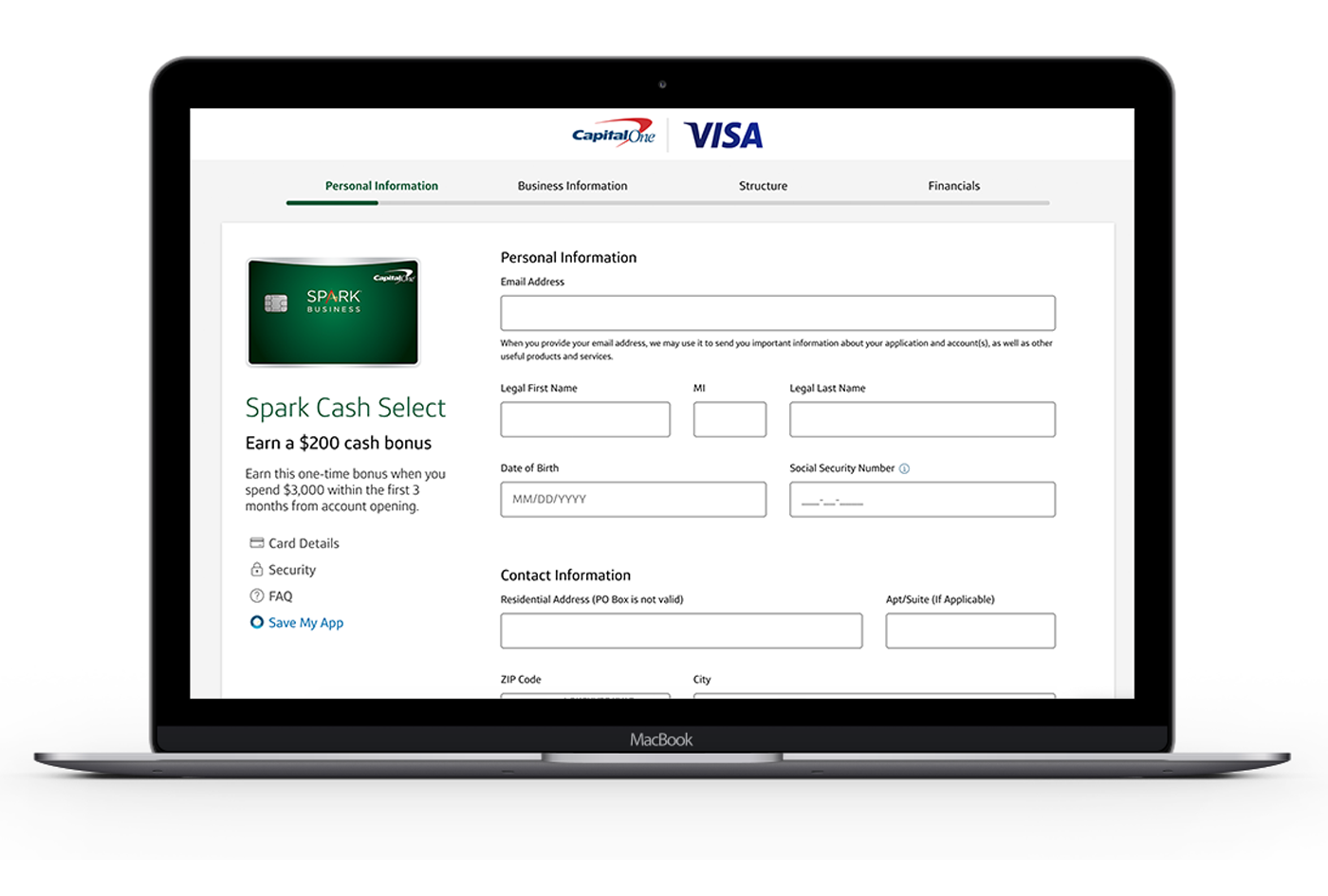

Capital One Business Card application is a static form that asks all customers the same information, does not save data to assist with prefill, and does not provide guidance along the way for difficult fields which causes customers to get stuck and drop off.

- Focus

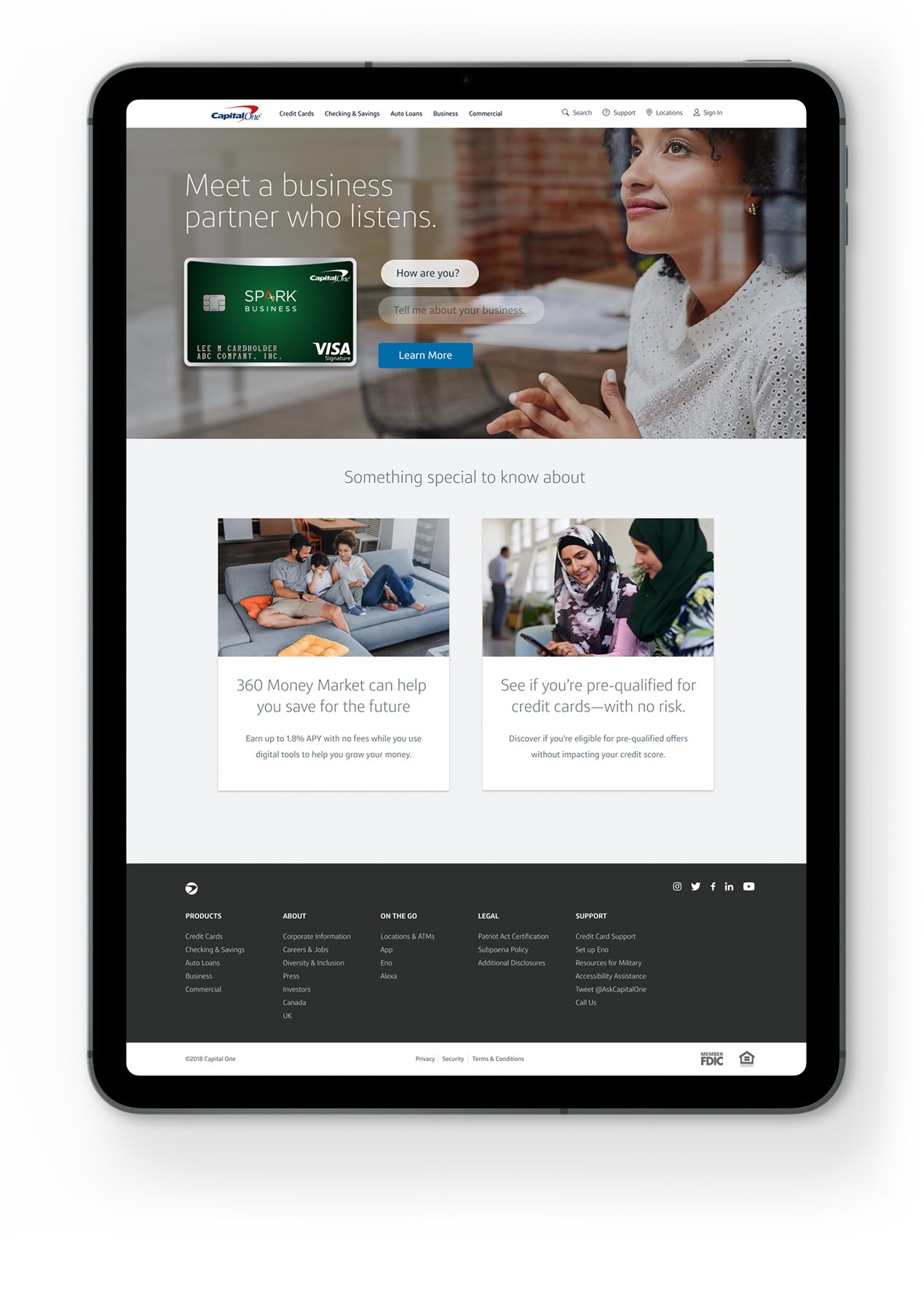

- Create a future vision of our application experience to gain leadership support.

- Timeline

- ~2 month for strategy, design concept, and stakeholder shareouts.

- Role

- As the UX Designer I contributed to the overall strategy and creating design concepts.

- Team

- Product Manager, Product Owner, Design Manager, and a Business Analyst.