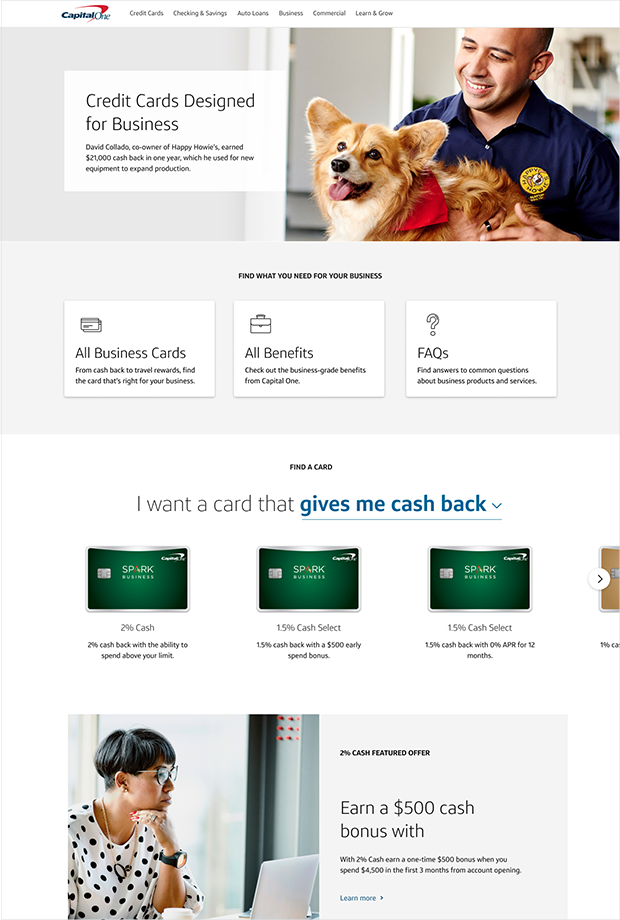

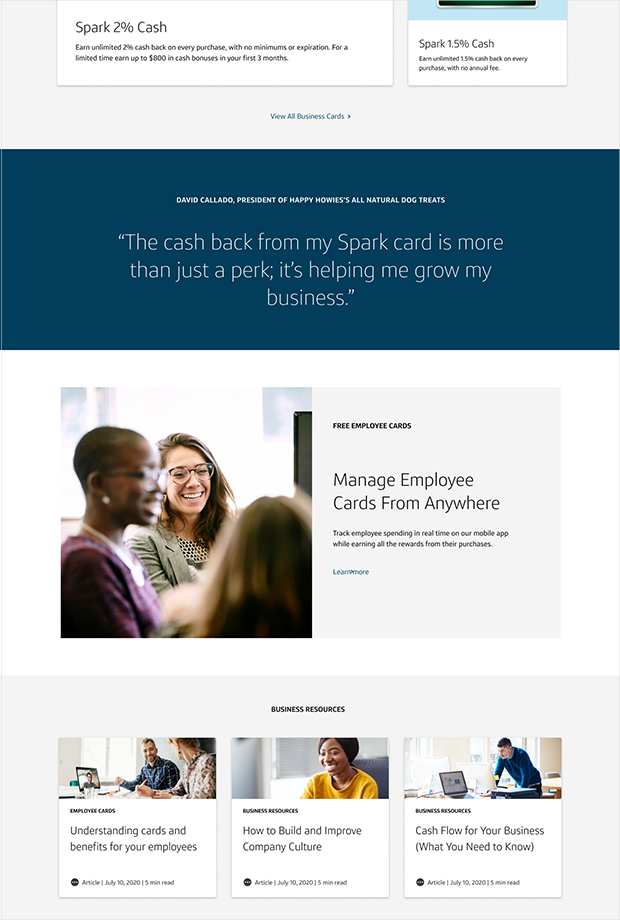

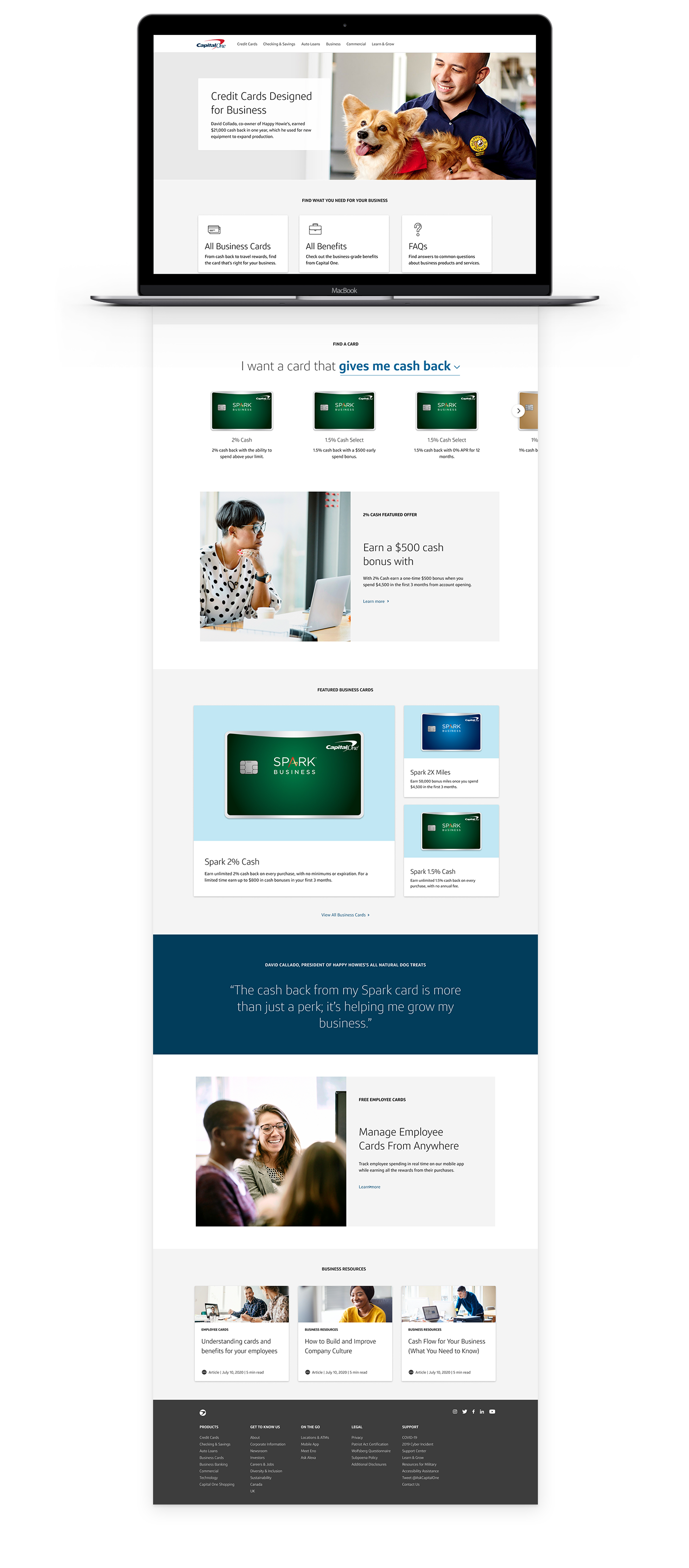

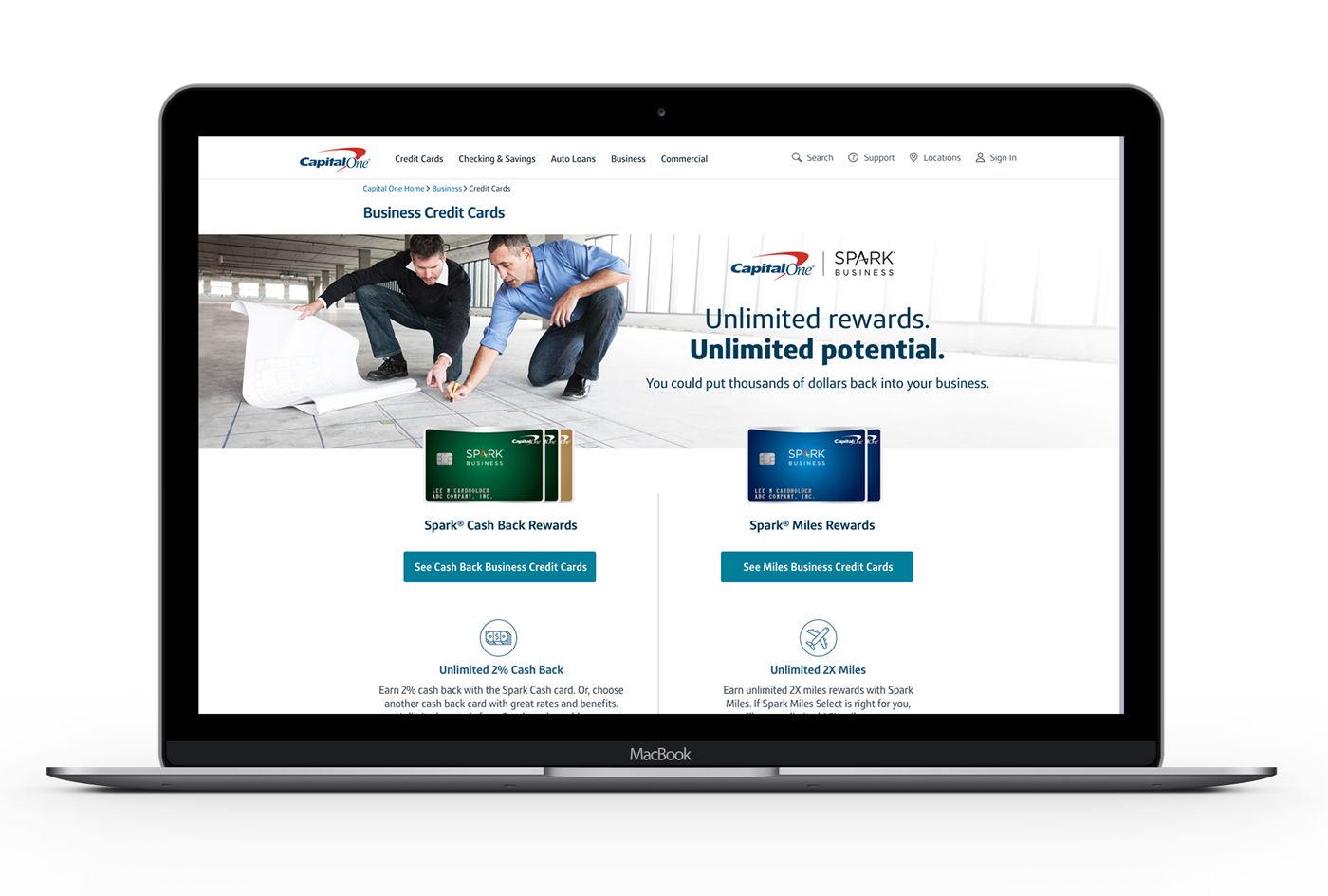

The Problem

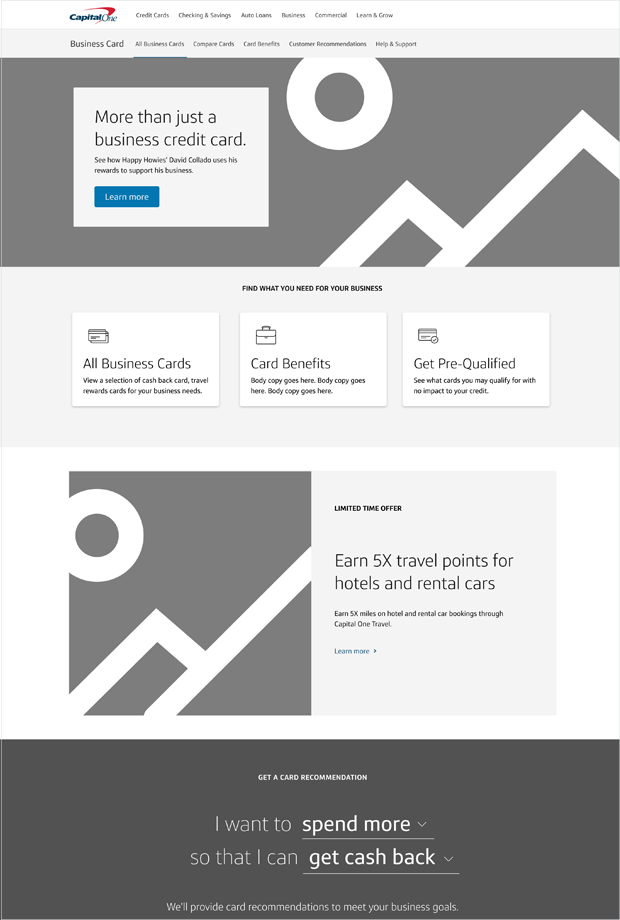

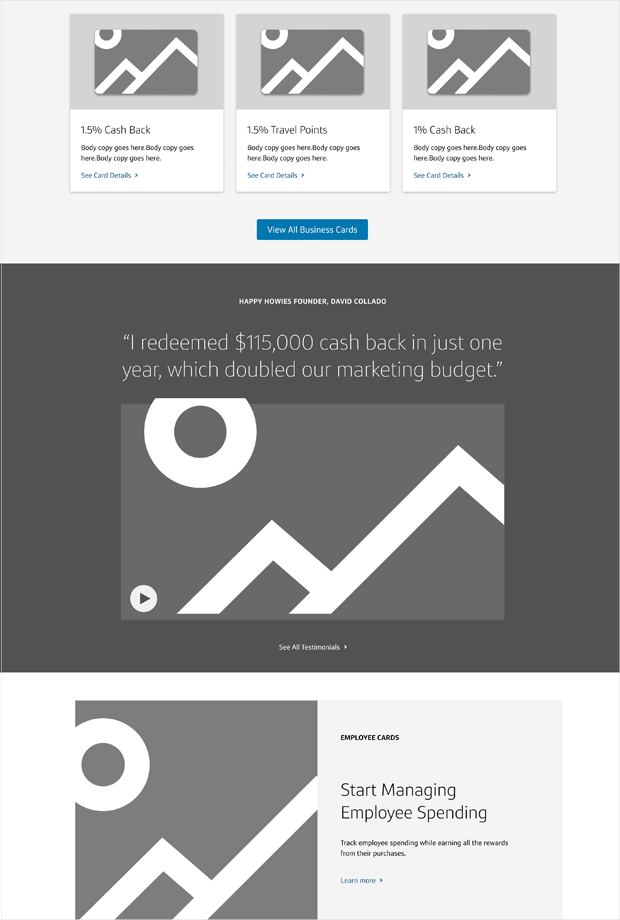

Based on foundational research, we discovered the majority of Business Owners are unable to navigate through the Capital One Business Card homepage to important pages, where they will find the information they need, to choose a credit card fit for their business.

- Focus

- Create a homepage that will provide a clear path for business owners to find key information.

- Timeline

- ~6 months for strategy, discovery, design, user research, approvals, development.

- Role

- As the Lead UX Designer I was responsible for all creation as well as stakeholder management.

- Team

- Product Manager, Marketing Manager, Design Manager, UX Researcher, Business Analyst, and Tech Team.